Changing jobs is often framed as a career decision—but it’s also a financial inflection point. One of the most common (and overlooked) questions that comes with a job change is:

“What should I do with my old 401(k)?”

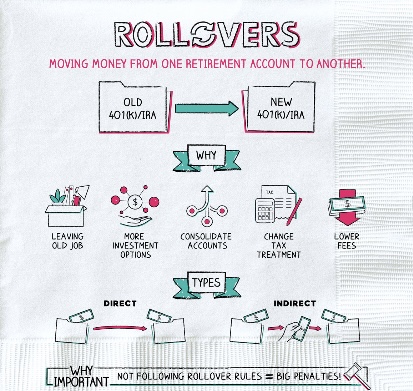

For many people, the default response is inaction: leaving the account behind with a former employer or rolling it over quickly without much analysis. In reality, this transition presents an opportunity to pause, evaluate, and make sure your retirement assets are aligned with your broader financial life.

A thoughtful 401(k) rollover evaluation isn’t about chasing better performance—it’s about clarity, fit, and long-term alignment.

Below are three core areas that deserve careful review before making a decision.

1. Comparing Investment Options: Choice and Flexibility

Employer-sponsored plans are designed for efficiency and scale, not personalization. While some 401(k) plans offer solid investment lineups, others can be limited in scope or overly restrictive.

When evaluating whether to keep assets in a former employer’s plan or roll them over, it’s worth asking:

- How diversified are the available investment options?

- Are the funds broadly diversified across asset classes?

- Is there flexibility to adjust holdings as your goals, risk tolerance, or timeline change?

A rollover to an individual retirement account (IRA), for example, may allow for a wider range of investment choices and more precise portfolio construction. The key question isn’t whether one option is “better,” but whether the investments fit your overall strategy and planning objectives.

2. Understanding Fees and Costs: What Are You Really Paying?

Fees are one of the few factors investors can control, yet they’re often buried deep within plan documents and fund disclosures.

When reviewing a 401(k) during a job change, it’s important to look beyond surface-level expense ratios and understand the full cost structure, including:

- Fund management expenses

- Administrative or recordkeeping fees

- Advisor or plan-level costs embedded in the plan

Small differences in fees may not feel meaningful year to year, but over time they can materially affect long-term outcomes. Evaluating costs isn’t about finding the cheapest option—it’s about understanding what you’re paying and what value you’re receiving in return.

3. Portfolio Allocation: Does It Still Make Sense?

Many 401(k) allocations are set years earlier—often based on default options or target-date funds selected during onboarding. A job change is a natural moment to revisit whether your portfolio still reflects:

- Your current risk tolerance

- Your time horizon

- Other assets you own outside the 401(k)

- Your long-term goals and priorities

Your retirement accounts don’t exist in isolation. They are one piece of a much larger financial picture. Evaluating a rollover allows you to assess whether your allocation still supports the life you’re trying to build—not just an abstract retirement age decades away.

This type of review aligns with a broader planning philosophy focused on helping money support meaningful experiences and long-term life goals, rather than simply accumulating accounts for their own sake .

Putting the Decision in a Broader Planning Context

A 401(k) rollover decision shouldn’t be made in a vacuum. Factors such as future career moves, tax planning, estate considerations, and personal priorities all play a role.

For many families, the goal isn’t just maximizing account balances—it’s achieving what might be called a “return on life”: using financial resources intentionally to support flexibility, fulfillment, and confidence over time .

That’s why a rollover evaluation is often less about the transaction itself and more about the conversation it sparks.

A Thoughtful Next Step

Not every 401(k) should be rolled over. In some cases, staying put may make sense. In others, consolidating accounts or adjusting structure may improve clarity and coordination.

The most important step is taking the time to evaluate your options before acting. A job change is already a transition—your finances deserve the same level of intentional review.