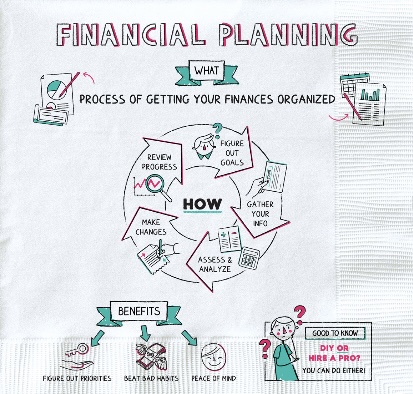

When people search for a financial planner, they often assume the role is primarily about investments — choosing portfolios, managing markets, and tracking performance.

In reality, investment management is only one part of comprehensive financial planning.

A financial planner helps individuals and families make informed financial decisions so their money supports the life they want to live — today and in the future.

Here’s what a financial planner actually helps with, beyond investments.

1. Providing Clarity About Your Financial Situation

Many people don’t feel financial stress because of a lack of income or savings — they feel stressed because they don’t have a clear understanding of where they stand.

A financial planner helps you:

- Organize accounts, assets, liabilities, and cash flow

- Understand how everything fits together

- Turn uncertainty into a clear financial picture

Clarity is often the first step toward confidence.

2. Aligning Your Money With Your Values and Goals

Financial planning isn’t just about numbers — it’s about priorities.

A planner helps connect your money to what matters most by:

- Clarifying personal goals and life priorities

- Aligning spending, saving, and planning decisions with those values

- Helping you avoid “default” financial choices that don’t reflect your intentions

This alignment is what turns financial planning into something meaningful — not mechanical.

3. Supporting Better Financial Decisions Throughout Life

Most financial decisions aren’t purely technical. They involve tradeoffs, timing, and emotion.

A financial planner helps you navigate decisions such as:

- Career changes or job transitions

- Major purchases

- Family and lifestyle changes

- Balancing saving for the future with enjoying life today

The goal isn’t perfection — it’s making thoughtful, informed choices that fit your life.

4. Managing Cash Flow and Financial Flexibility

Financial planning isn’t only about long-term goals like retirement. It also addresses how money works in your day-to-day life.

A planner helps you:

- Understand your cash flow

- Identify flexibility and constraints

- Balance present enjoyment with future responsibility

This approach helps prevent the common problem of planning extensively for the future while feeling restricted in the present.

5. Reducing Complexity and Financial Stress

Over time, financial lives tend to become more complicated — multiple accounts, overlapping strategies, and outdated assumptions.

A financial planner helps by:

- Simplifying where possible

- Identifying what still serves your goals and what doesn’t

- Creating systems that are easier to maintain and understand

Simpler plans are often more effective — and easier to stick with.

6. Adapting Your Plan as Life Changes

Financial planning is not a one-time event.

A planner helps you adjust your strategy as:

- Your career evolves

- Your family situation changes

- Your priorities shift

- Your definition of “enough” becomes clearer

Ongoing planning allows your financial strategy to evolve alongside your life.

7. Offering Perspective During Emotional or Uncertain Times

Money decisions are rarely just logical — emotions often play a major role.

A financial planner provides perspective by:

- Helping you slow down during uncertainty

- Reducing reactionary decisions

- Supporting disciplined, long-term thinking

Sometimes the most valuable role a planner plays is helping clients think clearly when emotions run high.

Where Investment Management Fits In

Investments matter — but they are a tool within a broader financial plan, not the plan itself.

A thoughtful investment strategy supports:

- Your time horizon

- Your comfort with risk

- Your cash flow needs

- Your long-term goals

Investments should serve your life — not dictate it.

The Real Value of Financial Planning

Ultimately, financial planning is not about chasing returns or optimizing spreadsheets.

It’s about:

- Clarity instead of confusion

- Intentional decisions instead of default choices

- Confidence instead of constant uncertainty

A financial planner helps ensure your money supports the life you want to live — not distracts from it.