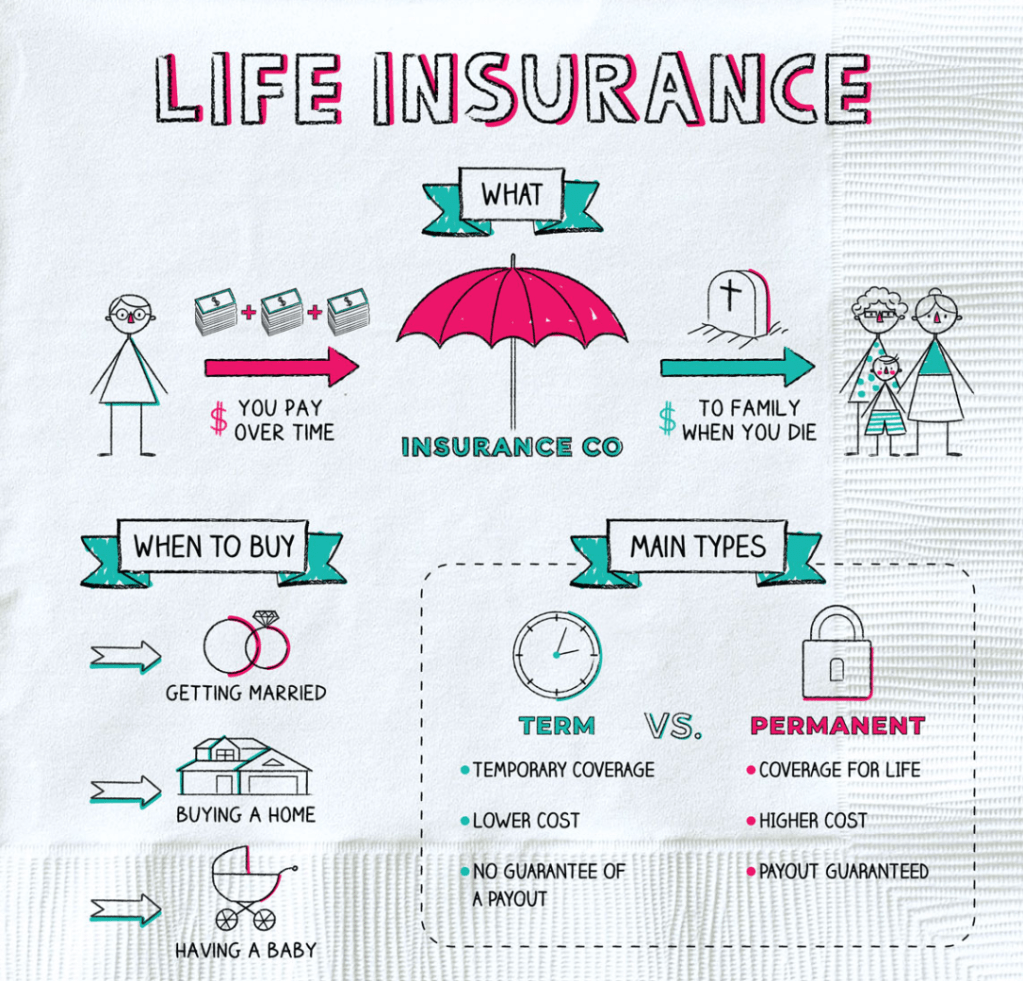

A commonly used analogy to describe the two broad forms of life insurance is: renting vs. owning. Term life insurance is like renting a home. When you stop paying for coverage, your benefits end. On the other hand, with permanent life insurance, you build up cash value (i.e., equity or ownership). This cash value is available to you for a variety of purposes and may even be used to help pay premiums on your policy.

Because term insurance costs keep rising, it eventually may become prohibitively expensive as you get older. After about age 40 to 45, premiums increase rapidly. In the long run, term insurance premiums can be a significant expense, making permanent life insurance an alternative that should be explored.

There may be situations, however, where term insurance is the best choice for a specific situation. Level-premium term policy (good for a specified number of years, typically in multiples of five) has come as a practical solution to protect a mortgage or similar time-bound need.

Permanent Insurance = Living Benefits

With permanent life insurance, premiums generally remain level. In the early years, premiums are substantially higher than the actual cost of protection, but this helps to build up cash reserves. These cash values accumulate on a tax-deferred basis.

If needed, you may borrow against the cash value at a generally competitive rate (the borrowing rate is spelled out in your policy). A policy’s cash value may eventually be used to help supplement college costs or retirement income. Simply put, the policy’s cash value is a benefit you can use while you are alive—something that term insurance does not offer. (Please note that loans and withdrawals will reduce the cash value and the death benefit.)

Certain “nonforfeiture” options in a permanent contract also give it a larger degree of flexibility. For instance, if you decide to stop paying premiums, you may, in some cases, be able to exercise one of several options by:

- converting the policy to “paid-up” status, which typically reduces

- coverage but requires no further premium payments;

- getting extended term coverage;

- surrendering the policy for its cash value; and

- perhaps obtaining an annuity that will produce an income for life.

If you were to become disabled and were unable to pay the premium, the waiver-of-premium rider could see you through difficult times. This policy addition, applied for when the policy is issued, helps ensure your premium obligations will be “waived” in the event you suffer a total disability. Although the disability waiver is available in a term policy, it is particularly appealing in a permanent contract because not only does it ensure protection for your family, it also guarantees cash accumulations will enjoy uninterrupted growth. With a waiver of premium, the insurance company is obligated to pay the premiums for as long as you are totally disabled and unable to earn an income.

Obviously, there are many advantages to living in your own home as opposed to being a tenant. Permanent life insurance has similar advantages in that it provides current protection, the potential for cash accumulation, and future appreciation in value. By the same token, just like owning a home, you need to be sure that the amount of permanent insurance you purchase fits within your budget while meeting your goals and objectives.

Sources:

- eMoney: Liberty Publishing, Inc. All rights reserved Distributed by Financial Media Exchange